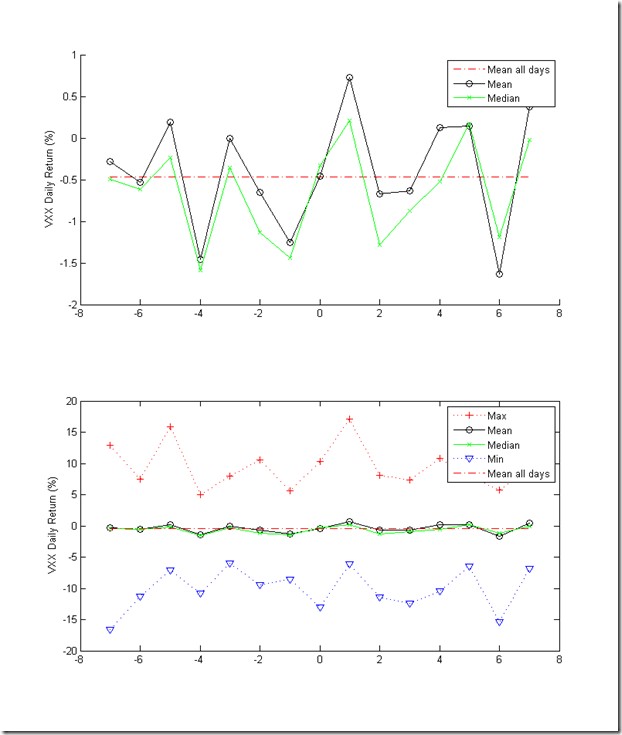

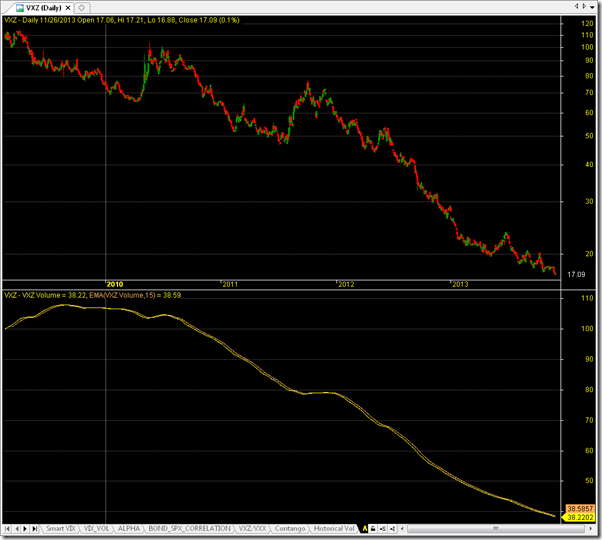

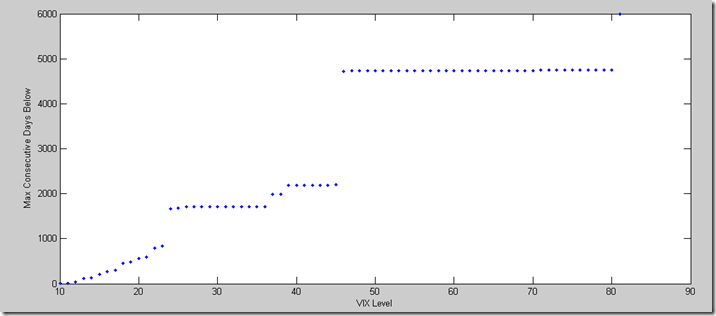

Most of the automated strategies only work well under certain market conditions. For example, many of the VIX future contango trend following strategies worked well 2009 through 2012, during which VIX was in a high range while trending downward. However, these same strategies has been performing poorly since 2013, during which VIX is in a low range and relatively flat.

It also seems that market conditions constantly change and cause almost no strategies work all the time. As a result, it’s important to know what market condition we are in and choose the appropriate strategies. In other words, what’s the big picture? In the long-term time frame in terms of years or even decades, are we in a bull or bear market? High or low volatility regime? Is the market or volatility trending downward or up?

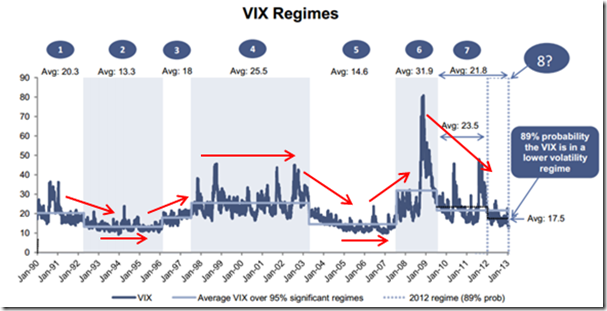

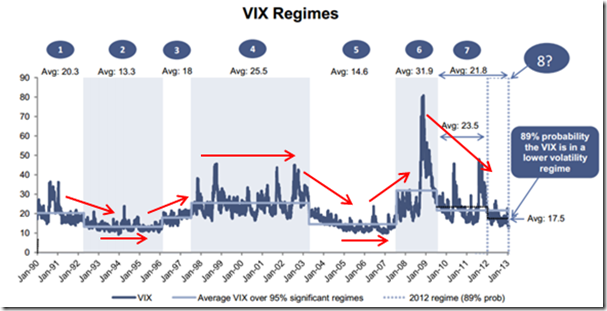

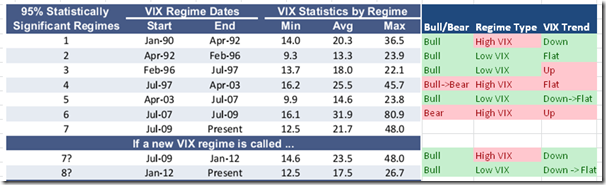

According to a GS report, there have been 8 regimes since 1990 (see the following figure). The longest regime (regime 4) lasted almost 6 years (Jul-97 – Apr 03), while the shorted (regime 3) lasted about one and half year (Feb, 96-Jul, 97). The latest ongoing regime 8 started in Jan 13. In general, the market has been switching between high and low volatility regimes.

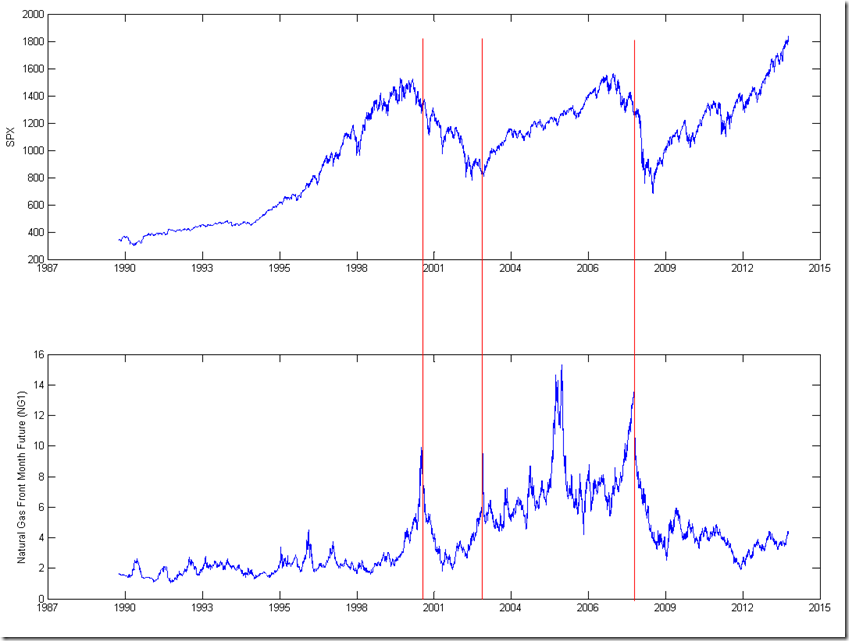

The following observations can be made from the VIX and SPY regimes. Note low volatility means VIX < 24.

- Bear markets always have high volatility.

- Bull markets can have either low or high volatility.

- It’s always a bull market in low volatility regimes, no matter the VIX is trending down or up. For example, it’s bull market during low volatility regimes 2 (vix trending down), 3 (vix trending up) and 4 (vix trending down).

- It can be either bull market or bear market during high volatility regimes. Moreover, high volatility can occur either at the early or late stages of bull markets, for example 97-2000 high volatility was the late stage of the decade long bull market, while 09-12 was the early stage of a bull market.

- Low volatility doesn’t occur at the late stage of bull markets.

We’re currently in a extremely low volatility regime. From the above observations, we should be in the late stage of bull market even though the current bull market has lasted for 4 years. We’re probably in the middle stage of bull market. Furthermore, the VIX is just trending down, we’re probably in the early middle stage of bull market. That means it’ll probably be years before the current bull market ends. Specifically, we may see the following possible scenarios in the coming years:

- Low volatility bull market while VIX bottoms out (1-3 years)

- Low volatility bull market while VIX trending up (1-2) years)

- Possible high volatility bull market. Actually this can be very likely if the first two predictions turn out to be true because it would be a extremely long bull market at that time it probably won’t ends easily. So it’ll probably go through a high volatility period before the market turns into a bear market.

- Bear market.

Based on the above predictions, there will be good opportunities of VIX based investments. We should be more aggressive in investing. At least get fully invested!